Jornal GGN – A Teoria Monetária Moderna, em sua sigla original MMT, conceitualiza um novo paradigma macroeconômico, ao defender que o Estado não deve se impor uma restrição financeira e que cabe a ele decidir, em última palavra, como usar as finanças públicas, garantindo políticas públicas e amplo emprego à população.

Apresentando-se como uma alternativa à economia neoliberal, o conceito que inclui uma nova visão sobre a moeda e o crédito nacional para responder às desigualdades sociais está sendo discutido mundo afora e ganhou espaço, também, no Brasil. E está detalhado no livro “Teoria Monetária Moderna – A chave para uma economia a serviço das pessoas”, lançado no Brasil pelos economistas Fabiano A. S. Dalto, Enzo M. Gerioni, Julia A. Ozzimolo, David Deccache, Daniel N. Conceição.

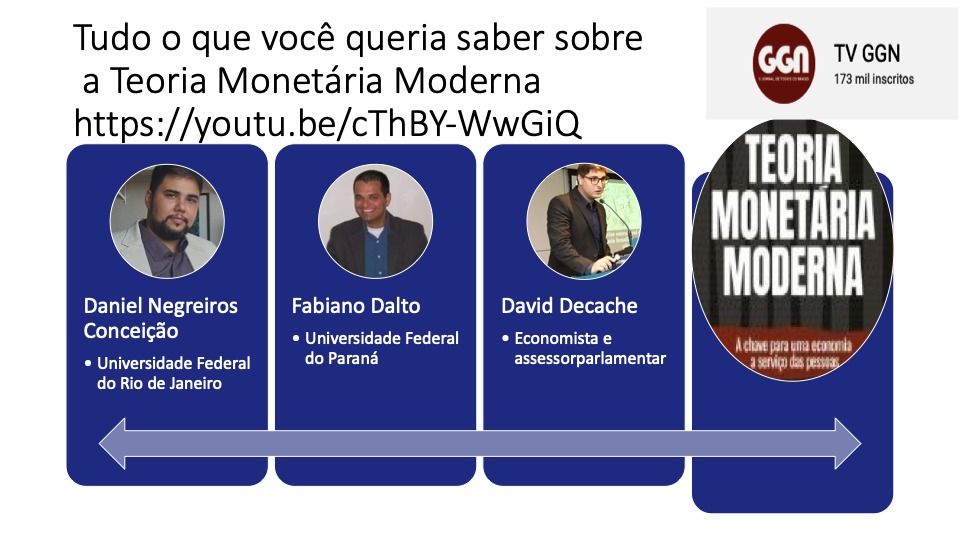

Para explicar do que se trata esta teoria, três dos autores do livro, Daniel Conceição, Fabiano Dalto e David Dacache participam de uma live, ao vivo, na TV GGN.

Você pode fazer o Jornal GGN ser cada vez melhor.

Apoie e faça parte desta caminhada para que ele se torne um veículo cada vez mais respeitado e forte.

produtos

produtos

DOMINÂNCIA FISCAL ..um conceito que ARREBENTOU COM O BRASIL nos anos de DILMA ..fez parte do GOLPE e do pânico ..foi trazido por MONICA DEBOILLE ..ele é tratado nesse vídeo como mais uma FAKE, um dogma, uma crença

Dr. Michael Hudson investigou e escreveu acerca da Theoria Moderna de Monetizacao. Aqui:

Michael Hudson on Modern Monetary Theory

Posted on July 31, 2017 by Nick Johnson

There is an enormous amount of information across the internet on Modern Monetary Theory (MMT). A search in google gives around 2.6 million results, while that for post-Keynesian produces a mere 974 thousand! Marxist economics gives even fewer, at 913 thousand.

Having said that, a search for Marxism produces 13.3 million results. Of course, Marxist thought has had an influence far beyond economics, and even philosophy, politics and sociology, into such fields as anthropology and psychology.

Here is maverick economics Professor Michael Hudson on MMT, taken from his book J is for Junk Economics (p.155-7). Hudson is supportive of the theory and the economic policies which it implies.

Later in the week I will outline some ideas on money and inflation drawn from Anwar Shaikh‘s 2016 work Capitalism. Shaikh is critical of some aspects of MMT and provides extensive theoretical discussion and empirical evidence to make his case for a ‘Classical’ theory of modern money and inflation.

“Modern Monetary Theory (MMT): MMT views money and credit as a public utility. Money is a legal creation, not a commodity like gold or silver. Creating it costs central banks or treasuries virtually nothing (likewise for banks creating their own electronic credit). Governments give money value by accepting it in payment of taxes and fees.

The folding money in people’s pockets is, technically, a government debt – but it is a debt that is not expected to be repaid. That debt – on the liabilities side of the government’s balance sheet – is an asset to money-holders. This money does not necessarily lead to inflation when labor and other resources are less than fully employed. By contrast, most bank credit is created to finance the purchase of real estate, stocks and bonds, and thus fuels asset-price inflation. That is a major difference between public and private money creation. And just as hydrocarbon fuels lead to environmental pollution and global warming, bank credit to bid up asset prices leaves a residue of debt deflation in the economic environment.

Banks promote a market for this debt creation by doing what other advertisers do: they sing the praises of their product, as if running up more debt (created electronically at almost no real cost to the bank) will make people richer (eg. by asset-price inflation) instead of leaving them more deeply indebted.

A major virtue of MMT is to dispel the illusion that all government spending comes from taxpayers. Not a penny of the $4.3 trillion that the Federal Reserve’s Quantitative Easing program has provided to Wall Street since 2008 came from taxpayers. Governments do (and should) create money by printing it (or today, creating it electronically), over and above the collection of taxes. Instead of only giving it to the banks at 0.1% interest, the Fed could just as easily have created money to spend into the economy for public programs.

MMT urges central banks or treasuries to monetize budget deficits by creating money to spend into the economy in this way. The government’s budget deficit is (by definition) the private sector’s surplus. By contrast, running budget surpluses (as the United States did for decades after the Civil War, and as it did in the Clinton Administration in the late 1990s) sucks money out of the economy, leading to fiscal drag. If public-debt money were to be repaid (by running a fiscal surplus), it would be removed from circulation. That is why budget surpluses are deflationary – and why balanced budgets fail to provide the economy with the money needed to grow and create jobs.

By not running deficits, the economy is obliged to rely on banks for the money and credit it needs to grow. Banks charge interest for providing this credit, leading to debt deflation. Neoliberals want to keep bank credit-money privatized. To keep it as a monopoly, they seek to block governments from creating money. Their aim is for governments to finance public spending only by taxing the 99 Percent – which drains revenue from the economy – or by borrowing from banks and bondholders at interest.

The popular illusion that all bank loans come from deposits and savings is kept alive by journalists such as columnist Paul Krugman of the New York Times despite the seemly obvious fact that since 2008 little new bank credit has been supplied by depositors. MMT Economists know that commercial banks can create money simply on their computers, by crediting the borrower’s account when the customer signs an IOU for the debt. The basic “service” that banks perform by their credit creation is to create debt, on which they charge interest. Loans thus create deposits – while also creating debt. When banks borrow reserves from the Federal Reserve (at just 0.1% interest), they are then able to charge as much interest as they can get their customers to pay.

Money always has been a claim on some debtor – a liability either of governments or banks. On the broadest plane, a holder of money has an implicit claim on society at large – which is in effect a collective debtor to the money holder. This private banker’s monopoly privilege of money creation can be maintained – and bank profits maximised – as long as they can by preventing a public bank from being created as a public utility to provide the economy with less expensive (and better directed) credit. That is why financial lobbyists try to convince the public that only private banks should create credit-money, instead of governments creating public money by deficit spending.”

E aqui o uso e abuso da MMT.

https://michael-hudson.com/2020/04/the-use-and-abuse-of-mmt/

Espero que voces apreciem.